What We Do

Our Services

Introduction to RDF Ghana’s Services

21,000+

GHS 93M

Our Products

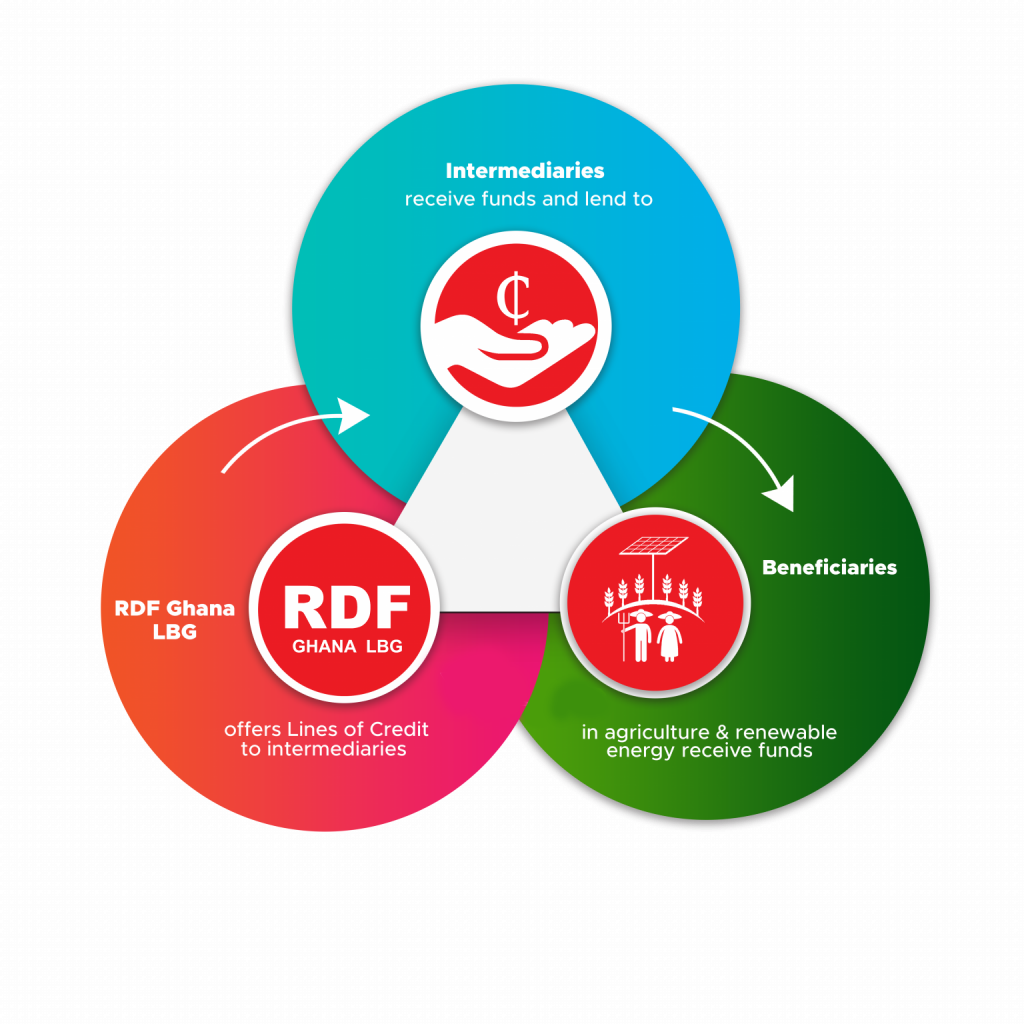

LINES OF CREDIT

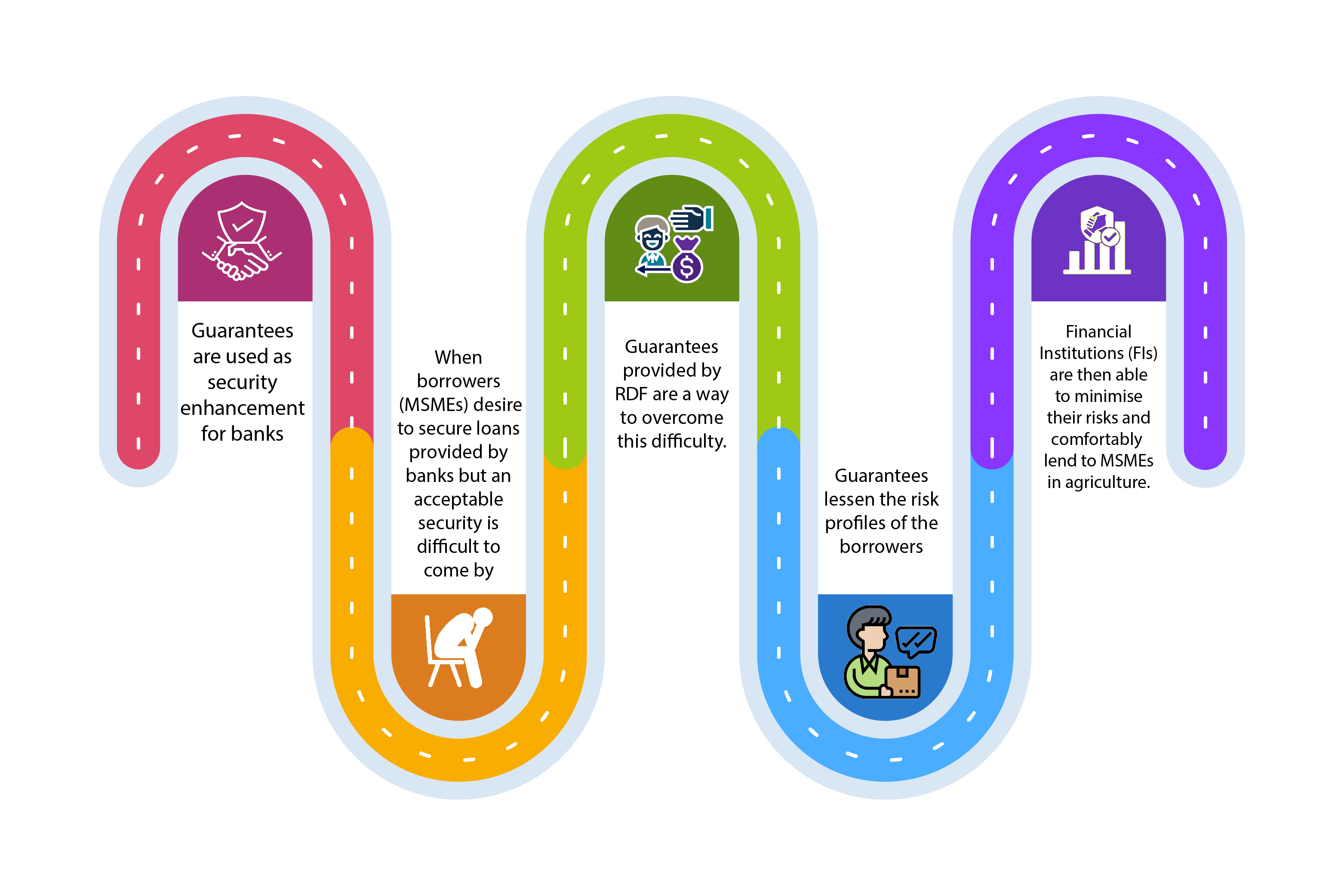

CREDIT GUARANTEES

RDF derisks loans to the agriculture and renewable energy sectors for Financial Institutions (FIs).

We offer a cover of 50% of losses on qualified term loans and loan portfolios.

How our credit guarantees work

GHS 38K+

Guarantees for MSMEs

Security Enhancement

Guarantees are used as security enhancement for banks when borrowers (MSMEs) desire to secure loans provided by banks but an acceptable security is difficult to come by.

Overcoming Difficulties

Guarantees provided by RDF are a way to overcome this difficulty. They lessen the risk profiles of the loans.

RDF Guarantees

Guarantees provided by RDF lessen the risk profiles of the loans for banks.

Risk Minimization

With the cushion provided by RDF’s credit guarantees, Financial Institutions (FIs) are then able to minimize their risks and comfortably lend to MSMEs in agriculture.

Comfortable Lending

Financial Institutions (FIs) can comfortably lend to MSMEs with the risk minimized through RDF’s guarantees.

21K+

TECHNICAL ASSISTANCE

We support PIs and our loan beneficiaries with the skills and technologies needed to make profitable use of our lines of credit and credit guarantees.

Our Beneficiaries

The bulk of our technical assistance (TA) budget is focused on supporting the MSMEs we provide funding to via our PFIs. To ensure that TA is most beneficial to these MSMEs, we discuss their needs and understand their challenges on our monitoring visits to their farms and places of business.

Our Partner Institutions (PIs)

Our PIs, as part of the application process, undergo extensive financial and legal due diligence. The weaknesses and challenges teased out of this due diligence process become the basis of the TA for our PFIs.

The Industry

RDF may decide to provide industry-wide or regional based technical assistance programme from a felt need as a result of interactions with the market including key players such as development partners and / or the regulator.