Investment Process

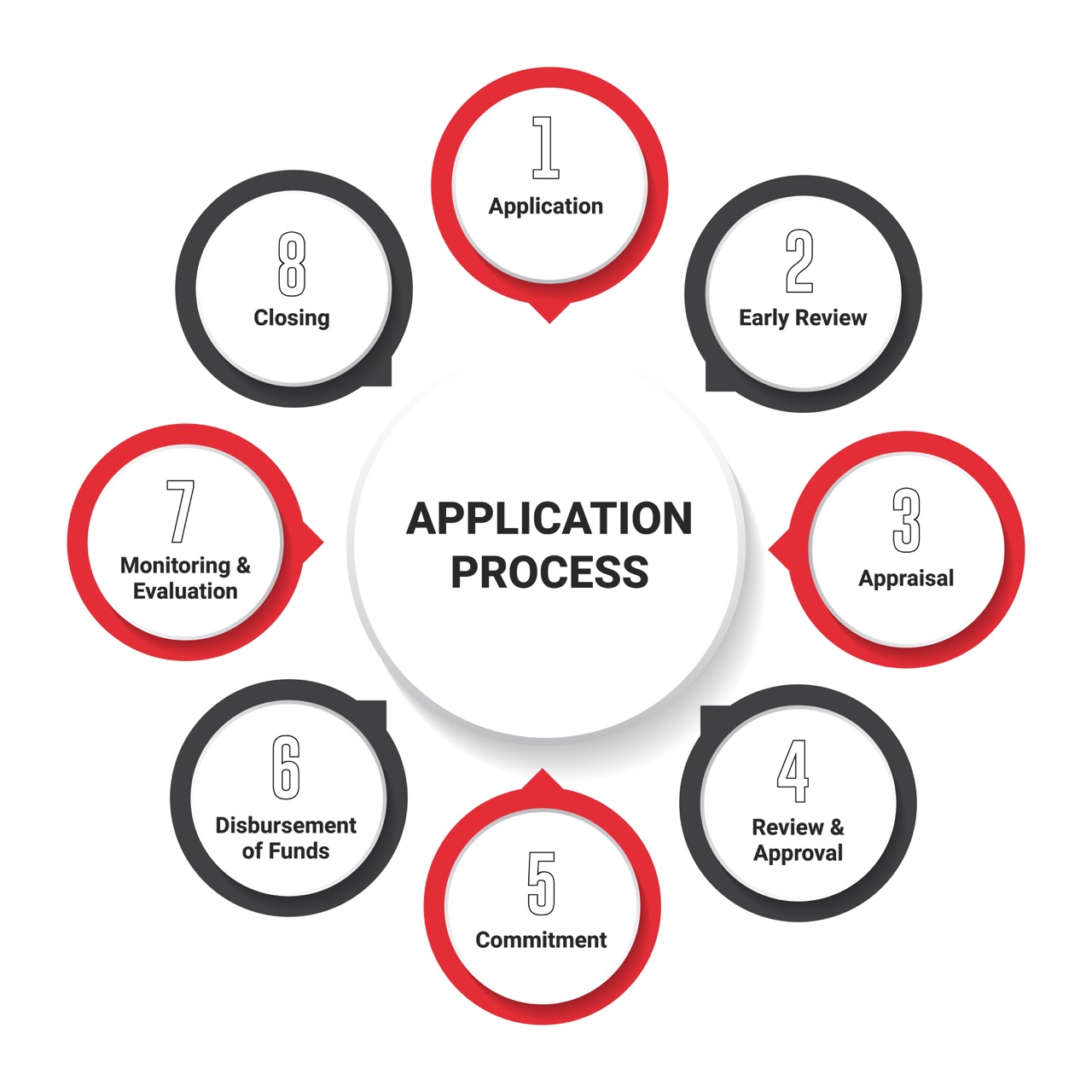

The facility application process at RDF Ghana is a structured pathway designed to ensure effective fund allocation. It begins with the submission of an application by intermediary institutions, followed by an early review to confirm eligibility

Facility Investment Process

RDF Ghana LBG follows a structured process to ensure transparency and efficiency in providing financial support to partner financial institutions

Financial Institutions (FIs) submit a formal application to RDF Ghana, including all required documentation.

RDF conducts an initial review to ensure the application meets basic eligibility criteria and guidelines.

A detailed assessment of the FI’s financial and operational capacity, as well as its alignment with RDF’s objectives, is conducted.

Applications are reviewed by RDF’s internal committees or boards for final approval.

Once approved, RDF issues a formal commitment letter outlining terms and conditions.

Funds are disbursed to the approved FI based on agreed terms, with disbursements possibly occurring in tranches.

RDF conducts ongoing assessments to ensure funds are being utilized effectively for the intended purposes.

Upon completion of the facility, RDF closes the account, ensuring all terms have been met and funds repaid.

POST DISBURSEMENT MONITORING

Role of Partner Financial Institutions

During the tenure of the loan, partner financial institutions shall visit the clients to ascertain the performance of the loans granted under the scheme. Quarterly reports including data on the loan repayments / recovery history of each loan made by partner financial institutions under the scheme will be submitted by partner financial institutions to RDF.

Role of RDF

Ongoing monitoring visits shall be undertaken by the RDF aimed at assessing the status of the performance of RDF investment with partner institutions.Involves off-site analysis of information from reports or any other sources to form an objective impression on the status of the institutional performance in respect of RDF investment.

Involves on-site visit to the institution with an agenda of issues identified so that proper conclusions about the status of RDF investment with the institution can be ascertained.

ANNUAL REVIEW

RDF shall undertake an annual review of the operations of partner financial institutions in respect of the performance of RDF investment. Review dates will be established with partner financial institutions during the disbursement process.The aim of the annual review is for the RDF to be abreast of the current operations of partner financial institutions and also for RDF to become aware of any warning sign(s) for remedial action to be taken.

MONITORING AND EVALUATION ACTIVITIES

RDF shall establish as appropriate monitoring and evaluation systems with clear baseline data, indicators, targets, and outputs including means of verification against which these targets and outputs can be measured.RDF Investment Staff shall undertake bi-yearly monitoring and evaluation activities involving a percentage sample (of clients) of partner financial institutions under the RDF investment scheme.