What We Do

CREDIT GUARANTEES

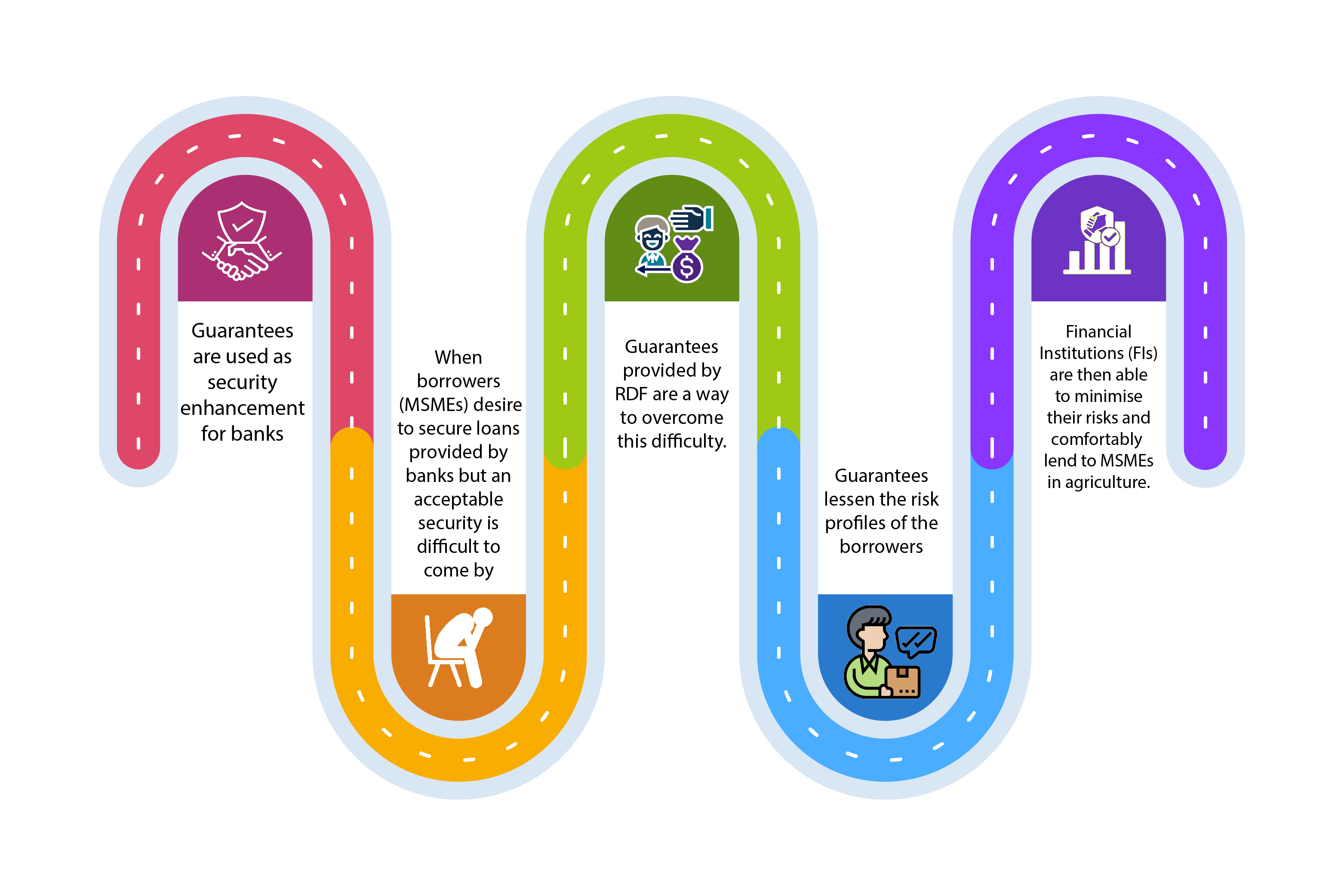

RDF derisks loans to the agriculture and renewable energy sectors for Financial Institutions (FIs).

We offer a cover of 50% of losses on qualified term loans and loan portfolios.

Deployed

GHS 38K+

Credit Guarantees to Financial Institutions

Risk-sharing tool offering 50% cover on agriculture and renewable energy loan defaults — designed to boost lending to rural MSMEs

Purpose

Encourage financial institutions to increase lending to agriculture and renewable energy MSMEs by covering 50% of principal losses in case of default.

Eligible Clients

- Universal Banks with rural presence

- Rural and Community Banks (RCBs)

- Microfinance Institutions (MFIs)

- Savings and Loans Companies (S&Ls)

Target Beneficiaries

MSMEs in agriculture and renewable energy — especially women- and youth-led businesses

Focus: poverty reduction, inclusion, income growth, climate resilience, and decent work

Copyright © 2025 RDF All rights reserved. Powered by AO Holdings.